Office In Home Deduction 2024 Form – Nine New York Jurors Saw Trump for Who He Really Is Ousted GOP Chair Warns Republicans: You ‘Could Be Next’ Hamas studies ceasefire proposal after deadly Israeli hospital raid in West Bank . If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. .

Office In Home Deduction 2024 Form

Source : www.cnbc.comHow to Deduct Student Loan Interest on Your Taxes (1098 E

Source : studentaid.govHere’s who qualifies for the home office deduction for 2023 taxes

Source : www.cnbc.comHome Office Tax Deduction in 2024 New Updates | TaxAct

Source : blog.taxact.com2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.comBGFS INC | Riverdale IL

Source : m.facebook.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comThese Are the New Federal Tax Brackets and Standard Deductions for

Source : www.barrons.comMore than a Meal (MTAM) / More than a Meal Campaign 2023 2024

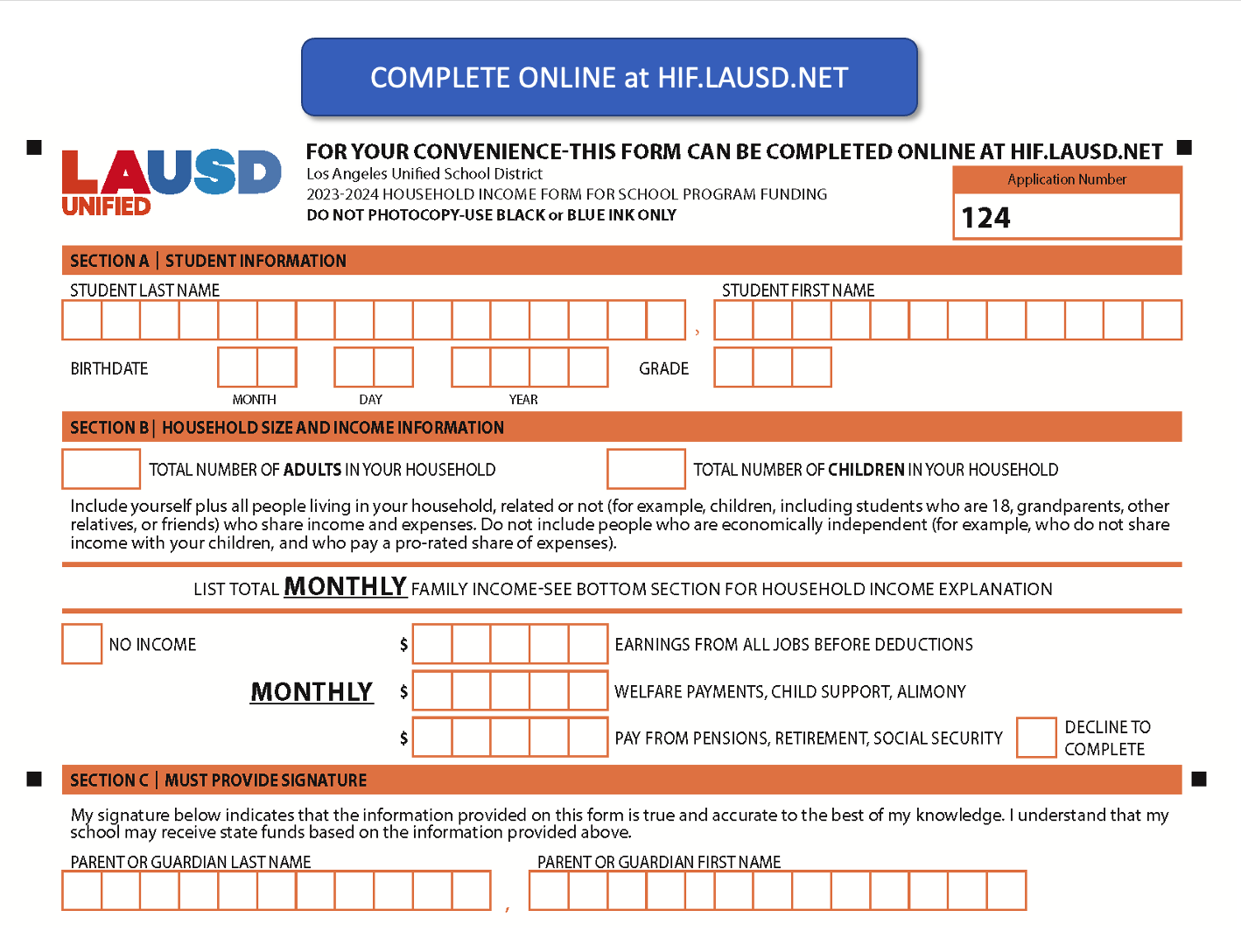

Source : www.lausd.orgThe Home Office Deduction TurboTax Tax Tips & Videos

Source : turbotax.intuit.comOffice In Home Deduction 2024 Form Here’s who qualifies for the home office deduction for 2023 taxes: The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . To be entitled to deduct home-office expenses, you must be required to use a part of your home for work. The CRA has confirmed that the requirement to maintain a home office need not be part of your .

]]>